Federal and state tax calculator

File the right forms. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax.

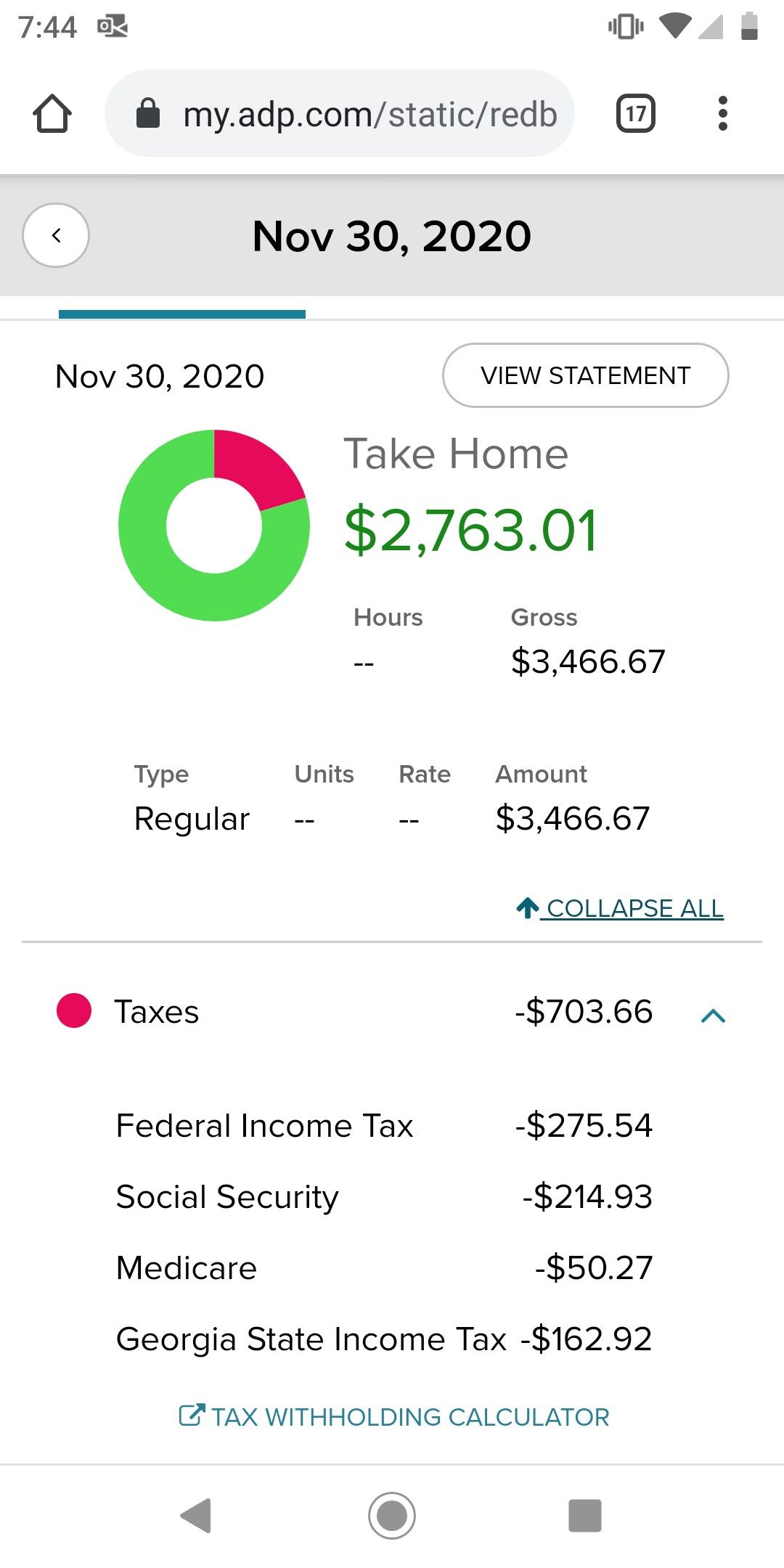

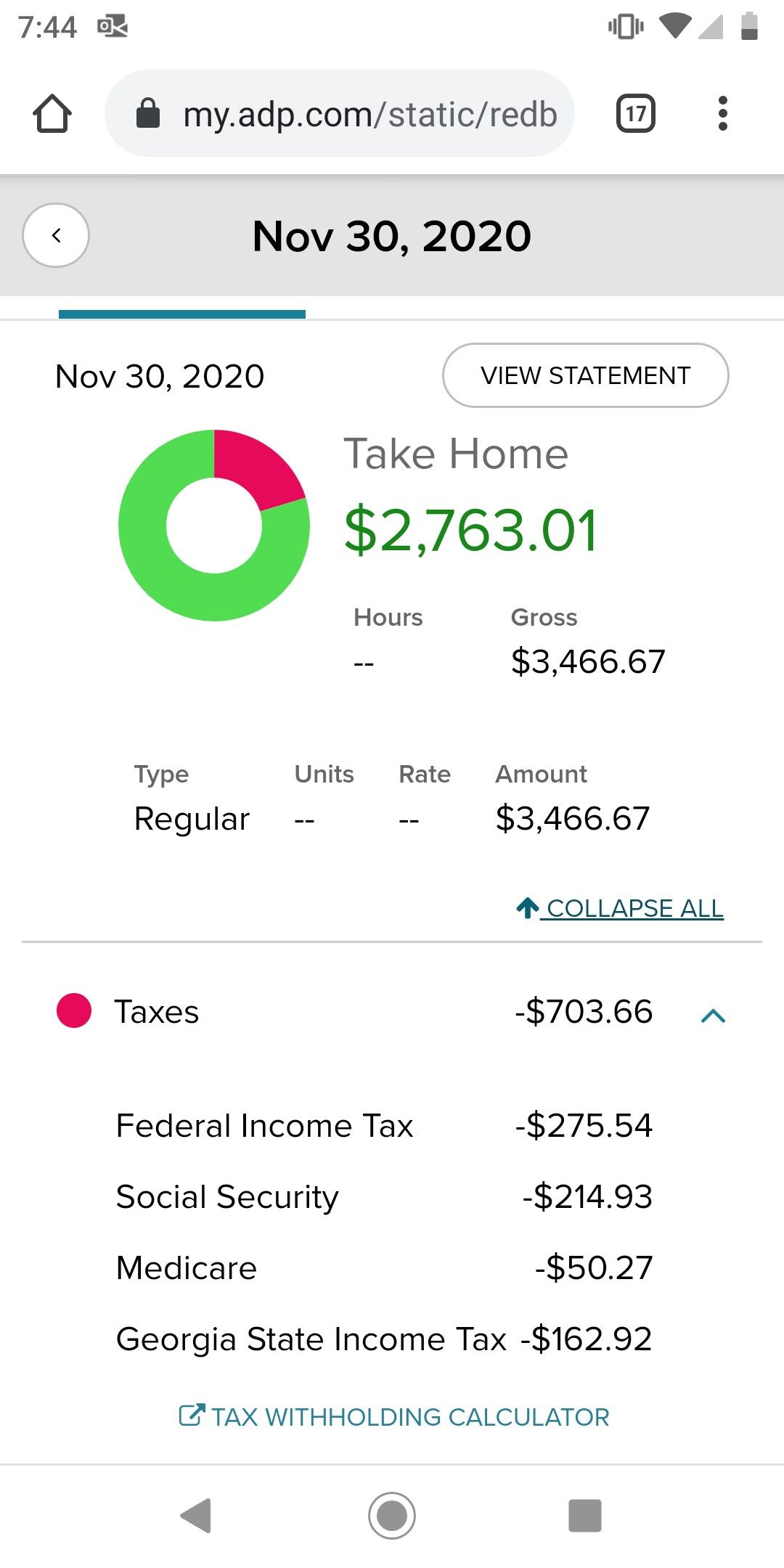

Pin By Perla Castillo On Me Federal Income Tax Unit Rate Georgia State

If you make 55000 a year living in the region of New York USA you will be taxed 11959.

. Expert News Commentary Trusted Analysis Time-saving Practice Tools. Federal income tax credit of up to 7500 for eligible all-electric and plug-in hybrid cars purchased new in or after 2010. Use our 1040 income tax calculator to estimate how much tax you might pay on your taxable income.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax. Washington ˈ w ɒ ʃ ɪ ŋ t ə n officially the State of Washington is a state in the Pacific Northwest region of the Western United StatesNamed for George Washingtonthe first US.

Click the category header or use the menu to the left. Plug-in Electric Drive Vehicle Credit. Federal Tax Rate Assumption.

Our online Annual tax calculator will automatically work out all your deductions. The Federal or IRS Taxes Are Listed. A federal tax of 24 percent will be taken from all prizes above 5000 including the jackpot before you receive your prize money.

First you need to determine your filing status to understand your tax bracket. 15 Tax Calculators 15 Tax Calculators. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that.

For example if an employee earns 1500 per week the. You may then be eligible for a refund or have to pay more. The State of Delaware transfer tax rate is 250.

State Federal and Territorial Income Taxes. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Our online Annual tax calculator will automatically work out all your deductions based.

Federal calculations will now use the official federal tax brackets and deductions and state calculations will use the most recent. Listed below are recent bulletins published by the National Finance Center. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Ad Analysis from Leading Practitioners and the Resources You Need to Make Informed Decisions. Please note for the calculator to work you must enter a value for each of the 8 assumptions for anything to calculate.

ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. That means that your net pay will be 43041 per year or 3587 per month.

Ad Analysis from Leading Practitioners and the Resources You Need to Make Informed Decisions. An estate tax is a tax imposed on the total value of a persons estate at the time of their death. There are five main steps to work out your income tax federal state liability or refunds.

The Minnesota Tax Calculator Lets You Calculate Your State Taxes For the Tax Year. It is sometimes referred to as a death tax Although states may impose their own. Delaware DE Transfer Tax.

Expert News Commentary Trusted Analysis Time-saving Practice Tools. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Avalara provides supported pre-built integration.

Income Filing Status State More options After-Tax Income 57688 After-Tax Income.

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro Adjusted Gross Income Income Federal Income Tax

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Free Income Tax Calculator Estimate Your Taxes Smartasset Income Tax Income Tax

Pin On Life In The Time Of The Corona Virus

4 Last Minute Tax Tips Tax Brackets Saving For Retirement Income Tax

What Is Annual Income How To Calculate Your Salary

Taxation Of Corporate Income Income Tax Enterprise Development

Employee Payroll Information Payroll Calculator And Payroll Invoice In 2022 Invoice Template Payroll Federal Income Tax

Tax Calculation Spreadsheet Worksheet Template How To Memorize Things Printable Worksheets

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax

Pin On Raj Excel

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Spreadsheet Template Life Planning Printables